I have not posted for some time due to a series of issues which (other than technical ‘issues’) can best be explained as ‘family issues’ – of course in avoiding work or coming up with excuses these can be explained in a number of ways, all prefixed with ‘family’ or ‘personal’ followed by words such as:

‘issues‘

This is a good one as it is really criptic and people dont want to ask – and if they do you can just tell them you can’t talk about it due to some legal issues (using issues twice in the one sentence is a surefire was to get them to stop asking).

‘tragedy‘

Unfortunately this must have some truth to is as people will ask what – it is okay because a grandparent that nobody knows can in fact be tragically ill over a very long period and can even die a couple of times so long as you dont mix excuses with the same people.

‘dramas‘

Almost as fantastically cryptic as issues but often leads people to think that you may be in some danger – use it only when you can become upset and that will stop people from asking anything further.

‘bullshit‘

A great one for men (actually they are all good for men talking to men because no man wants to get involved in another man’s business which may involve showing any emotion) – so bullshit is fantastic and then all other men can reply ‘Yeah, I know what you mean, fucking families – bullshit!’ – and then everyone continues on their way and you get to take that day off to play golf.

So which one am I going to use for my lack of posts.

None….. it’s one I just discovered!

It’s over spending and living on credit.

That’s what I have been doing and when I took stock I realised that I was approaching bankruptcy and no matter where I went I couldn’t get any credit, I couldn’t get any refunds and most of all not even my friends or relatives could give me a loan (mainly due to personal or family issues, tragedy, dramas or bullshit).

Yep, it had come to that point where I was completely out of and could not get hold of the only commodity that counts – time.

I actually had enough money, a nice home, a good wife, kids to be proud of but, no time.

I actually did an audit and realised that some out of control spending had to go. Some things I just couldn’t afford. I decided that the following were going to get culled or only be used in my spending regime under the strictest of circumstances:

Television

I had decided this a long time ago but kept on spending – in fact during the audit I found that it was a massive hidden cost. It was like finding the leaking tap around the side of the house that had increased my water bill tenfold but I hadn’t noticed. It was a continuous drip that accumulated into a massive expense. And, in all honesty do I care who cooks the best roast or who gets voted off the island or who the Bachelor picks to stay with for 5 minutes during the finale Solution: Never switch it on unless you have really planned to watch something. Never choose it as the first option to ‘relax’ when you have nothing else planned – plan something else (doing this may be a new skill that has to be learned and may require some training!) Advanced Budgeting: Sell a few that fill your house and have only one in the house. (Read a book, that helps too!)Regrets

I realised that I had been paying a huge amount of interest on regrets that were bad investments in the first place. The worst part of these debts is that it prevented me from borrowing anything now, and as it turned out that now can be a very long time. It is hard to give yourself a credit rating when you give yourself no credit. Solution: It actually dawned on me that these interest payments either had to be written off as bad debts – which means basically forgiven – or paid in full. Most times the final payment can be made with a simple ‘sorry’ (you have to actually mean it!). Advanced Budgeting: If you get your credit rating back, don’t lose it again – remember Albert Einstein’s definition of insanity regularly referred to by me which is “doing the same thing over and over again and expecting a different result”.Doing What You Hate

After my wife was diagnosed with breast cancer we decided that our days would not be filled dragging ourselves through our days doing things we didn’t have to and in fact hated. It was simple – 1). We hated doing the dishes – we bought a dishwasher; yeah it was a few dinners we couldn’t go out for or ‘luxuries’ we wanted now that we would have to save for, but the investment was worth it. 2). We hated cleaning – we got a cleaner – yes, this was a luxury and a pretty big expense and sometimes seems like a waste of money (although it is giving someone a job) – but, when we get home on that fortnightly Wednesday to a wonderful clean house it is all worth it. 3). Stop working at that job. Yeah, we all have to live but we also all die and if you need some reminding have a dinner party with all your immortal friends and get them to bring around all the things they are going to take with them when they die. It has to be said…. if you do what you love you will never work a day in your life. I like to add, that if you work all your life at something you hate, then in all honesty you are a bloody idiot. Plus for those of you who want to say I work to live not live to work – get a grip – work life balance is a myth created by people who don’t want to work – it is just called ‘life’ sort it out or live in the previous paragraph. Solution: Figure out what it is that you are doing that really is not adding to your life and ween yourself off of it – save for the dishwasher – find the cleaner who needs the work and you can afford – have a dream about your work and start (even tiny steps) to make it happen. Advanced Budgeting: Stop. Really, really have a look at your values and live them. Read these posts: Better an appreciative question, Better at Leaving, Better Authority, Responsibility and Concern…..Hanging Out With People Who Don’t Add to Your Life

Wow this is a biggy. This is not often so much about the debt you are getting into but all the commodities your are lending when you actually know you will never get paid back. Yeah, we all do it and then get a bit sooky and ‘hurt’ when they renege on the loan – I love it when they tell you they thought it was a gift not a loan! If you are in a circle of friends and all talking about the person who isn’t there, then you are in the wrong circle of friends. Not adding to your life does not necessarily mean taking away from it – it can be as simple as holding you in a place that you never thought you would settle for (see above paragraph). I think understanding that happiness is not the absence of despair is very important. I think it is also very important that we give up the ‘life-long-friend no-matter-what’ as an idea that is good in theory but rare in practice – it is just that we don’t let it go when it is already gone and we end up hanging around with someone we hate and talk about when they are not in the circle. If you need more than one hand to count your ‘real friends’ on let me know your definition of a real friend… bet it’s different from mine. Loyalty is my base value; but that loyalty must also be to my base values. Solution: Figure out who rings who and for what reason and stop ringing and often this ‘problem’ just goes away. Lose the obligation and the initiation and you lose the friend you suddenly realised you didn’t want anyway. Advanced Budgeting: Pick right in the first place. Some of my best friends are my newest friends – met me and our values met – it’s not hard after that.

So here we are knowing where the spending has gone rampant and ready to do a budget. The thing about all budgets is working out what are essentials and what are luxuries. I was thinking about this recently where most people (read children, teenagers…) think that a flat screen TV of at least 50 inches and a mobile phone are essentials. I remind my children that the essentials are actually food, water, shelter, clothing, safety and a reasonable chance at an education… all else is a bonus – especially going over on your data use by hundreds of dollars because talking about nothing was considered essential!

I think any new budget should consider the advice from those that have really run out of time as in what I wrote in my post Better an Appreciative Question about the “Top 5 Regrets People Have on Their Deathbeds.”

So here’s my new budget:

I will be truly present where I am at that time

Tips & Tricks

– If I am talking to you face to face I will not answer my phone

– Better than the above, I will put it on silent during any conversation (and out of sight)

– I will listen more than I talk

– I will be more Mindful

I will be on time and expect the same

Tips and Tricks

– Let everyone know this – actually do it

– If you are late I will leave, start eating, not extend our time together as you wasted yours and undervalued mine (it is the ONLY commodity)

– I will not reschedule or wait just because you rang 5 minutes before to tell me that something else got in the way (I hear something else was a priority above me and when I do hear your excuse because I have waited half and hour – I think ‘really?’ that was more important than me).

– See above point – I am not answering my phone or it is on silent

If I catch myself getting into old habits I will stop

Tips and Tricks – Budgeting is like dieting – you have to watch it all the time and when you are halfwaythrough the hamburger you bourght from old habits, on impulse, it doesn’t mean you have to finish it (who ever does that!!)

– Budgeting is like dieting – you have to watch it all the time and when you are halfwaythrough the hamburger you bourght from old habits, on impulse, it doesn’t mean you have to finish it (who ever does that!!)

– you know where the switch is to turn the TV off stand-by but you never do it…. life is full of switch to flick, you just have to do it….. angry/forgiving…. sad/happy…. dissatisfied/grateful….

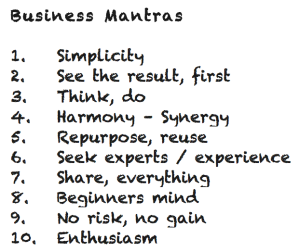

I will live my mantras and remind myself constantly

Tips and Tricks – Write ’em down, put em up – big posters, dream boards, wish lists inthe open are hard to ignore (especially if they are on top of the TV!) and need explaining to friends and family – now we are all on the same page!

– Write ’em down, put em up – big posters, dream boards, wish lists inthe open are hard to ignore (especially if they are on top of the TV!) and need explaining to friends and family – now we are all on the same page!

– I will be Be peaceful, Be mindful, Give a positive impression, Live in harmony and not make things to complicated

Finally…

I will follow my true instincts and values

Tips and Tricks

– this is the ‘daily limit’ on your account that stops you bankrupting yourself

– even with my new budget I will not go against my values and instincts (we are on the top of the food chain by having the best instincts and intuition)

– I will break my budget rather than my heart, if in my heart it is a good purchase (I will wait for my friend who is late if they need me that day, sometimes I will need to talk a bit more than listen, sometimes my budgetary requirements will clash and I will follow me heart)

Living My New Budget

Sorry that the practical advice about how to save those minutes in folding the clothes or making the bed or getting that meeting over or report done is not here….. our time is not wasted by doing things, it is wasted by us not doing the right things in the right priority.

I know people who know the price of everything and the value of nothing…. it really is about counting the pennies (usually from heaven!) and the pounds will look after themselves (Translation – look after the cents and the dollars will look after themselves).

Considering the average life is over 2 BILLION seconds you have to think, where have the ones gone already and what am I going to do next…..

Hang on a second, rarely is. You cant get it back, it’s spent.

Being fugal isn’t the answer, being wise is.

The other day someone told me they could not make a funeral as a meeting had been rescheduled at the same time….. (that is the end of that comment and sentence as I can’t think of what to say…. how about WTF!)

Strangely enough following on from the above I went around to the friends’ house whose funeral it was, and guess what, it was all still there – he didn’t take any of it with him……

So……

I will spend wisely.

I will spend on things of value.

I will not live on credit.

I will ensure when I go the the ATM (the At The Moment machine) that I don’t get my card skimmed and my accounts are balanced.

Pingback: Better at Parties - Being A Better ManBeing A Better Man